How to Calculate Recurring Revenue

More app developers are considering how to incorporate recurring revenue into their applications.

More app developers are considering how to incorporate recurring revenue into their applications. This comes as Apple has incentivized subscriptions by lowering their fees after one year of subscription renewals and adding support for introductory pricing. Before leaping into a recurring revenue stream, it’s important to have some intuition about how revenue works for an app with subscriptions.

A Standard Revenue Model

For normal, one-time purchases, revenue can be modeled as the following:

Revenue equation for an app with one-time purchases.

Downloads is the number of new users downloading your app. Conversion rate is the probability that a user buys your in-app purchase, ranging from 0.0 (no purchases), to 1.0 (everyone purchases). The average price is the price paid on average for a purchase.

One thing to know about this model is that the conversion rate depends on the price. The conversion rate is roughly inversely related to the price: if the price decreases, the conversion rate will improve. The relationship follows a sort of demand curve. The conversion rate can be improved without changing the price. This can be done by doing things like adding new features, improving the app experience, or changing the placement of the point of purchase.

A Recurring Revenue Model

The recurring revenue looks somewhat similar to the one-time model, with the addition of revenue coming from renewals. And, by the way, RevenueCat calculates this for you out-of-the-box.

The recurring revenue model adds a non-linear term dependent on the churn rate.

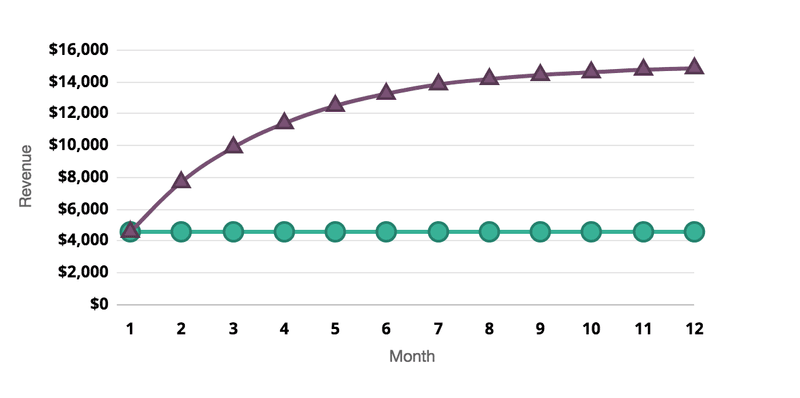

The revenue for a month equates to all the new business from said month plus revenue from previous months. Recurring revenue from previous months is reduced from its original level because some proportion of subscribed users will stop renewing their subscriptions, churning out. This proportion is called the churn rate.

The churn rate (CR) is the proportion of users who unsubscribe every month. Churn can become a powerful lever in boosting revenue because monthly revenue grows exponentially as the churn rate approaches zero. However, a typical value for churn rate is anywhere from .15 to .50 but depends heavily on the nature of the subscription.

Thanks nerd, but what does it all mean!?

Unfortunately, non-linear functions with co-dependent parameters aren’t so easy to think about. Sometimes the best way to understand a complex equation is just to see it in action.

Playing with the different combinations of conversion rate, monthly price, and churn rate, you will hopefully gain an intuition for the dynamics of a recurring revenue model. You can also check out the examples below to see some different scenarios.

Other Examples

One-Time Expensive vs. Recurring Cheap

One Time Expensive: A user pays a higher price once

Recurring Cheap: A cheaper, recurring subscription

Recurring Expensive vs. Recurring Cheap

Recurring Expensive: A user pays a higher price recurring, lower conversion Recurring Cheap: A cheaper, recurring subscription, higher conversion, lower churn

High Churn vs. Low Churn

High Churn: A relatively high churn rate Low Churn: A relatively low churn rate

You might also like

- Blog post

Is monetization hurting your app’s user experience?

Don’t trade short-term revenue for long-term trust. How ethical UX can still drive effective monetization.

- Blog post

Meta Ads in 2025: Expert tips from Marcus Burke

Marcus Burke discusses AI, UGC, and the lifespan of ad creatives.

- Blog post

The creative testing system that slashed our CAC (and scaled our spend)

We scaled Meta ad spend by 74.6% and dropped CAC 40%. Here’s how.