Understanding how much revenue your app can expect from each customer is crucial for making smart decisions. That’s where Lifetime Value (LTV) comes in. LTV is a key insight into the health of your business, helping you figure out everything from how much to spend on marketing to which features keep users coming back.

But while LTV is incredibly useful, it isn’t without its limitations. Monetization streams are complex, and apps are constantly evolving, which means relying solely on LTV can lead to misleading conclusions. This means that you need to approach it with a nuanced understanding, particularly when it comes to balancing long-term predictions with immediate business needs.

In this post, we’ll break down what LTV is, why it matters, the limitations that come with it, and how to navigate these challenges effectively. We’ll also introduce you to RevenueCat’s tools, including the Prediction Explorer, that can help you make the most of LTV while avoiding common pitfalls.

What is LTV?

Lifetime Value (LTV) is more than just a single number — it’s a function of several key factors that together paint a picture of how much revenue a customer is likely to generate over their time with your app. LTV is essentially a measure of how many subscribers are paying you, how much they are paying, and for how long.

- Number of subscribers: This is the total count of paying customers or users within a specific cohort.

- Subscription price: This represents the amount each subscriber pays for their subscription over a given period (e.g., monthly, yearly).

- Subscription duration: This reflects how long a customer stays subscribed to your app, which is crucial for calculating the total revenue they’ll generate over time.

What do we mean by “cohort”?

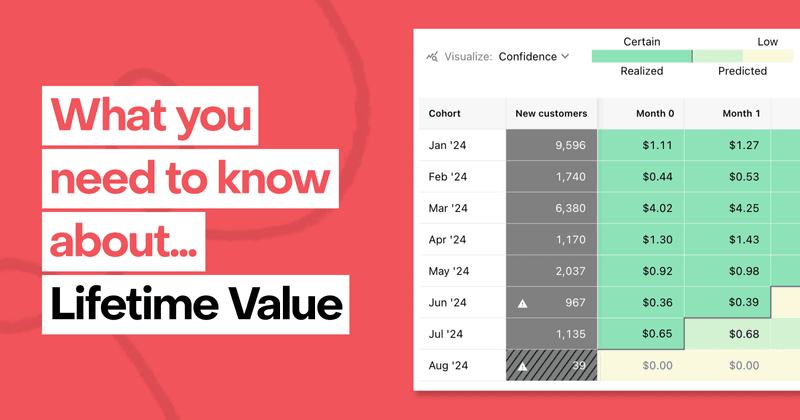

A cohort is a group of users who share a common characteristic within a specific time frame. For example, in RevenueCat’s Prediction Explorer (more on this later) cohorts can be defined based on when customers were first seen, when they made their first conversion, or when they made their first purchase. Tracking LTV by cohort allows you to analyze how different groups of users contribute to your overall revenue over time, helping you understand trends and make more informed decisions.

These factors can be viewed in terms of Realized LTV and Predicted LTV:

- Realized LTV is the revenue that has already been generated within a defined period — money that’s already in the bank.

- Predicted LTV extends this by estimating the future revenue you can expect from your current subscribers based on their past behavior and projected trends.

Together, these components give you a more granular and actionable understanding of your customers’ value, helping you make informed decisions on everything from marketing spend to product development.

RevenueCat makes it easy to calculate and track these metrics with our tools like the Cohort Explorer (for realized LTV) and the Prediction Explorer (for predicted LTV).

Why LTV matters

- Guiding marketing spend: LTV helps you decide how much to invest in acquiring new users. When your LTV surpasses your Customer Acquisition Cost (CAC), it confirms that your growth efforts are not just sustainable but profitable. However, it’s crucial to track LTV on a granular level. This means breaking down LTV by different cohorts and filtering by factors such as geography, platform, or acquisition channel. For instance, LTV might vary significantly between users acquired through different marketing channels or users from different regions. Understanding these nuances allows you to allocate your marketing budget more effectively and optimize your strategies based on specific user behaviors.

- Informing product development: LTV insights can reveal which features keep customers engaged, helping you focus on what drives the most value.

- Revenue forecasting: By predicting future revenue from current customers, LTV allows you to allocate resources efficiently and set realistic financial goals.

The limitations of LTV

While LTV is a valuable metric, it’s crucial to understand its limitations — especially in the context of marketing for subscription apps:

1. Long-term predictions can be fragile

Estimating LTV over a long period can be problematic. As user behavior evolves and your app undergoes updates, the original LTV estimates can become inaccurate. A new feature that significantly alters user engagement, such as a revamped onboarding process or a new subscription tier, can either boost or reduce retention rates, impacting the accuracy of your LTV predictions. Additionally, external factors like changes in market conditions, shifts in user demographics, or even a new competitor entering the market can alter user behavior in unexpected ways, further complicating your ability to rely on previous LTV estimates.

2. Clarifying the “lifetime” in LTV for subscription apps

The concept of “lifetime” in LTV doesn’t imply a fixed user lifespan, but rather a period within which value is measured. Whether you are calculating LTV over 1 month, 6 months, or 2 years, you are simply tracking how much value a cohort generates during that timeframe. In subscription apps, where recurring payments are often fixed, this allows for relatively stable predictions compared to more volatile one-time purchase models. However, because engagement and behavior can fluctuate, predictions over long time frames are inherently more volatile than shorter ones. Therefore, it’s crucial to balance long-term predictions with regular updates to ensure accuracy.

3. Focus on payback periods

While long-term LTV predictions are useful for understanding the trajectory of your business, they should not be the sole focus when setting your Customer Acquisition Cost (CAC). Instead, it’s critical to also focus on the CAC payback window — the time it takes to recoup your acquisition costs.

However, this doesn’t mean LTV should be disregarded in this process. In fact, LTV is an essential component in calculating your payback period. It’s important to use LTV as an input, whether you’re looking at short-term Realized LTV (RLTV) or longer-term Predicted LTV. The goal is to understand how quickly your investment in acquiring new users translates into returns.

Subscription businesses, in particular, offer unique flexibility. For example, you might charge a yearly subscription upfront, recouping most or all of your CAC quickly, while still benefiting from recurring renewals down the line. In this scenario, your payback window may extend beyond the initial purchase, especially if you’re aiming for higher returns, such as 1.5x or 2x your CAC. Having confidence in the retention of those subscribers in the long term allows you to justify a higher acquisition spend.

4. Complex monetization models

Apps increasingly rely on diverse revenue streams, combining subscriptions, in-app purchases, and ads. This complexity makes it challenging to calculate a single LTV figure that captures the full picture of a user’s value. LTV predictions must consider these multiple revenue sources and be flexible enough to adapt as the business evolves.

Overcoming LTV’s limitations

While there are limitations to LTV, they don’t render the metric useless. Instead, they highlight the importance of using LTV thoughtfully and in combination with other data points:

- Use LTV as one of many metrics: LTV should be part of a broader strategy that includes other important metrics like payback periods, churn rates, and recurring revenue. By considering these additional factors, you can gain a more comprehensive understanding of your app’s financial health.

- Think in segments, not just totals: Don’t think of LTV only as a measure of your full subscriber base’s lifetime value. Instead, consider how LTV differs across various segments of your user base. For example, understanding the difference in LTV between yearly and monthly subscribers can help you optimize your pricing strategy. This segmentation can inform decisions such as how much of a discount to offer for annual plans or which subscription options to emphasize in your paywall. Segmenting your audience also enables you to tailor retention strategies for different cohorts, ensuring more targeted and effective interventions.

- Regularly update LTV projections and segmentation: Given the fluid nature of the app market, it’s essential to revisit and adjust your LTV projections regularly. This involves updating your prediction models to reflect the most recent user behavior and market conditions. Additionally, as your product evolves or you explore new growth strategies, the way you segment or cohort your users may need to change. For example, introducing a new channel with less qualified leads could lower your overall LTV, requiring you to adjust your expectations and calculations accordingly. Similarly, as you improve your product, onboarding, or paywall, your early retention and conversion rates might no longer be accurate.

- Use RevenueCat for better insights: Tools like RevenueCat’s Prediction Explorer help you navigate the complexities of LTV by providing accurate, up-to-date predictions. By combining Predictive LTV with Realized LTV, you can create a balanced view that guides smarter, more strategic decisions.

Introducing Prediction Explorer

RevenueCat’s Prediction Explorer is designed to help you make the most of LTV by providing a nuanced, data-driven approach to understanding customer value. Here’s how it works:

- Cohort analysis: Group your customers based on specific actions such as their first seen date, first conversion, or first purchase. Prediction Explorer tracks how these distinct customer cohorts perform over time, allowing you to understand how different segments contribute to your overall LTV and revenue. Each cohort is defined uniquely, so the same customer can be part of multiple cohorts depending on their behavior.

- Survival curves: These illustrate churn probabilities over time, helping you translate these into renewal opportunities. By focusing on these probabilities, you can make more accurate predictions about future revenue.

- Real-time data updates: The Prediction Explorer continuously updates its data, ensuring that your LTV predictions are always based on the latest information. This helps you stay agile and responsive to changes in the market.

- Filtering and segmentation: Filter your data by factors such as country, app, or acquisition channel to gain more granular insights into how different segments of your user base contribute to your overall LTV. This feature allows you to tailor your analysis to specific regions, platforms, or marketing campaigns, making your LTV projections even more precise.

Explore Prediction Explorer a little further in this video from our developer advocate, Charlie.

In summary

- LTV is a key metric for understanding customer value: It helps guide strategic decisions around marketing spend, product development, and long-term forecasting by providing insights into the revenue potential of your customer base.

- Leverage LTV as part of a broader strategy: While LTV is essential, it works best when used alongside other important metrics like CAC payback periods, churn rates, and recurring revenue. A comprehensive approach will provide a clearer view of your app’s financial health.

- Segment your user base for more precise insights: Don’t think of LTV only as a single number representing your full customer base. Segmenting users by subscription type, platform, or acquisition source gives you a more accurate understanding of where the highest value lies, helping you optimize both acquisition and retention strategies.

- RevenueCat handles the complexities for you: RevenueCat’s tools, like the Prediction Explorer, automatically keep your LTV calculations and predictions up-to-date using real-time data. This means you can confidently rely on both Realized and Predicted LTV to inform your decisions, without having to manually refine or adjust your models.

- Stay proactive, but grounded in data: While LTV predictions offer a clear long-term view, it’s important to balance them with immediate financial goals, such as CAC payback windows, to ensure your growth strategies remain sustainable and profitable. RevenueCat’s tools provide the data you need to strike that balance effectively.