Is it time to stop offering free trials? Here’s why you should A/B test it

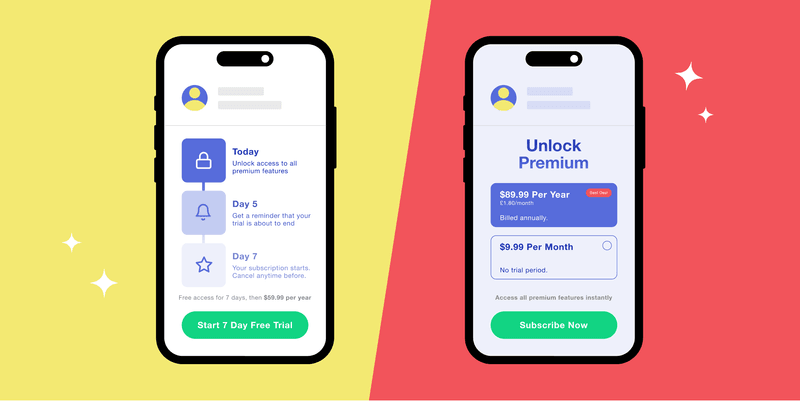

Free trials can boost conversions, but they can also drain revenue. Should your app take the risk?

I think we can all agree this question is one of the hottest topics for anyone responsible for growing subscription apps. It doesn’t matter if you’re the CEO, CMO, or UA manager: you’ve probably wondered if free trials are actually a good indicator of real subscribers, or if they’re hurting your app’s chances to monetize users.

Today, we’ll look at why testing a subscription app without a free trial is important and how you can find out if it makes sense for your app.

Taking a look at the benchmarks

Before diving into the topic and checking real numbers, it’s helpful to look at the industry landscape. In 2023’s State of Subscription Apps report, RevenueCat gives a clear picture of what most apps are doing when it comes to offering free trials.

It’s pretty clear, right? Only 28% of apps don’t offer a free trial – that’s a small minority. But why? Why would an app refuse to give potential customers a few days to explore the full product and see if it’s a good fit?

We have to remember that a free trial is just one strategy. It relies on how “sticky” the product and features are to convince users to subscribe. It’s a trust-based approach, depending on how well the product meets the user’s needs in the moment.

And believe me, some apps really rely on product quality:

As you can see, while most trials last between 4–9 days, some apps offer full premium access for more than 30 days! Offering such a long trial shows huge confidence in the product’s appeal. But there’s a risk: during that time, users may also discover the app’s weaknesses, lose interest, and decide not to subscribe.

But does that mean apps that don’t offer free trials don’t trust their product and just rely on marketing? Not exactly. Keep reading to find out why.

Real case study: The difference between free trial and no free trial

Let me show you what happened with a new subscription app that launched at the end of September 2024. Unlike its competitors, this app removed the free trial entirely.

For context, we ran this experiment over nearly two months – November and part of December 2024. You can see this in the New Trials graphic:

When I started managing this project and the paid campaigns in October (a month after launch), the numbers looked solid compared to benchmarks in the State of Subscription Apps report. Our Start Rate was 15.5% (the upper quartile in our category was 11%), and our conversion rate was 37.9%, right around the industry average for that year. Here’s the data:

Pretty stable performance, right? The app launched with a simple paywall offering a yearly subscription with no trial and a weekly subscription with a trial – and the numbers were in our favor! That’s rare for a new app in its first month.

However, after analyzing the campaign performance, we noticed that the costs of running these campaigns required us to have a much higher retention rate for weekly subscribers than usual. Since the app was brand new, we weren’t generating any organic growth – we were fully reliant on paid campaigns.

Sure, we could have invested more time and money in optimizing the current setup – A/B testing the funnel, improving creatives, or adjusting pricing. But after realizing that all competitors were using the same type of paywall (yearly subscription with no free trial, weekly subscription with a 3-day trial), we saw a problem. To grow organically in this niche, we’d need to spend a lot of money just to stay competitive.

So, we decided to take a more aggressive approach. Instead of relying on the product to convince users, we’d lean into our marketing strategy.

The strategy: Removing the free trial

We switched from a simple paywall with two options to one with six pricing tiers, and none of them offered a free trial. We added:

- Three monthly subscription options

- Three yearly subscription options

The difference between them? The features included in each tier. This made the more expensive packages more attractive to users.

We made this change because our competitors were using identical onboarding, pricing, and features. It was a niche filled with duplicated apps – the only difference was the color of their icons.

Here’s what we thought:

- We were the latest app in a crowded niche.

- While we offered some different features, the core of our app was the same as our competitors’.

- To match their revenue, we’d have to spend a lot on organic growth—and that wasn’t sustainable.

So, we asked: Why not try an approach that increases LTV enough to fully support our ad spend?

To make the campaigns work and create positive cash flow month over month, we needed to double our LTV. Removing the free trial was our best shot at doing that.

Why removing the free trial worked

Here’s why this strategy made sense:

- Users willing to subscribe would do it sooner.

- Monthly pricing tiers were set up to steer users toward options with higher LTV than four weekly subscriptions.

- Yearly subscription pricing was also higher than our original yearly plan.

And the results? This graphic speaks for itself:

We almost doubled LTV per paying customer from $35–40 to over $60 in just one month. This allowed us to scale up paid campaigns, shifting from AEO campaigns optimized for free trials to campaigns optimized for direct purchases.

Why this change matters for paid campaigns

At first glance, this might seem like a small change, but it has a big impact on your paid performance. Why?

Because the algorithm goes from targeting users who might start a free trial (but may not pay) to targeting people who directly purchase. This means you can “teach” the algorithm to find paying users, not just potential ones.

The downside? Your CPA will likely go up compared to campaigns optimized for free trials. This means you’ll need to allocate higher daily budgets, as the algorithm requires at least 10 events per day.

However, if you create the right ad creatives for paying users, you can manage the CPA by guiding the algorithm to the audience that’s most likely to subscribe.

Conclusion

Free trials are the most common setup for subscription apps, but if your app isn’t performing as well as you need, it might be worth testing a paywall without a free trial.

If you decide to remove the free trial, don’t just stop at the initial results. Seeing positive numbers is only the beginning. From there, you can implement additional strategies to improve conversion rates, such as:

- Optimizing ASO to convert more users in the stores, lowering CPI for your paid campaigns.

- Refining ad creatives to reduce CPA and attract more paying users.

- Improving the onboarding process to boost the conversion rate from download to subscription.

- A/B testing different prices for the no-trial paywall to see if you can further increase LTV or conversion rates.

You might also like

- Blog post

Modeling attribution on iOS: what works, what doesn’t, and how to choose

How to navigate the messy world of SKAN, AEM, and probabilistic attribution — plus two practical frameworks to get a clearer picture of campaign performance.

- Blog post

Your sprints must pay for themselves: Dan Layfield’s product advice

What’s worth building? Dan Layfield shares a 3-bucket framework to help app teams prioritize features, fix churn, and ship faster.

- Blog post

Is monetization hurting your app’s user experience?

Don’t trade short-term revenue for long-term trust. How ethical UX can still drive effective monetization.