Reconciling with App Store Financial Reports

When managing your app's revenue and overall financial performance, you might frequently need to use both our Revenue chart and the App Store’s financial reports for different purposes. While they both report on the financial performance of your app, there are meaningful differences in the recommended use cases and available data between those sources. Understanding these differences can help you better interpret the data and make more informed decisions.

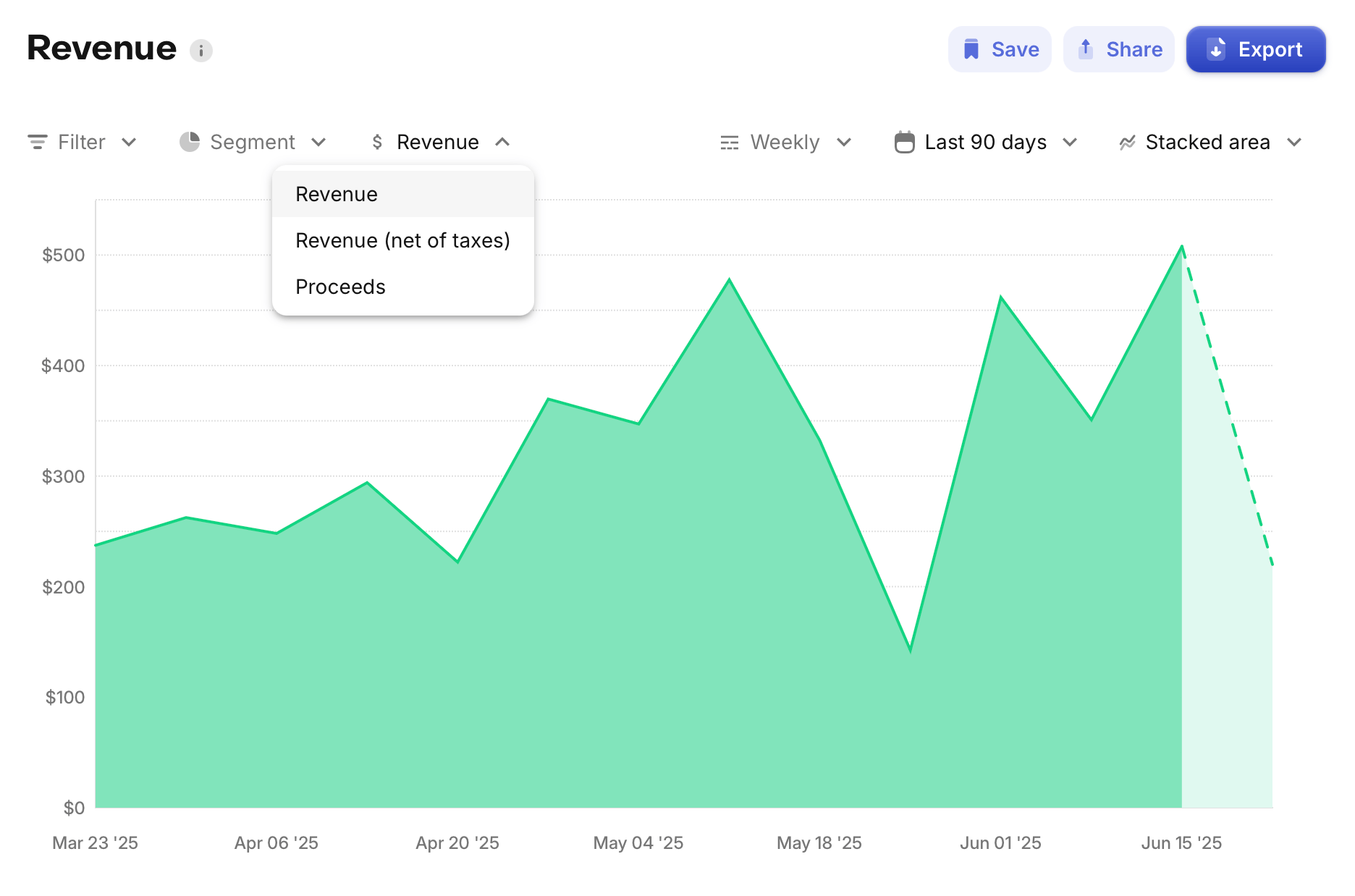

How the Revenue chart works

The Revenue chart reports total revenue generated by an app in a given period, minus any refunds issued for the transactions from that period. The chart's primary purpose is to help you understand your app's overall financial performance on a daily basis so that you can track trends over time, quickly spot changes, and estimate earnings.

Each underlying transaction that we track has a transaction date — the date when the purchase was initiated, or when an existing subscription was due to renew, which is provided by the App Store.

The Revenue chart supports three different revenue measurements, which can be selected from the chart's settings:

- Revenue: The total revenue generated in a given period, minus refunds from transactions that occurred in that period.

- Revenue (net of taxes): Revenue generated in a given period (as defined above), minus our estimate of revenue deducted from the stores for taxes (e.g. VAT, DST, etc).

- Proceeds: Revenue generated in a given period (as defined above), minus our estimate of revenue deducted from the stores for taxes and commission.

For example, if you sold a product for $99.99 that was not refunded:

- Revenue: $99.99

- Revenue (net of taxes): $94.99 ($99.99 after 5% was deducted for taxes)

- Proceeds: $66.49 ($94.99 after 30% was deducted for commission)

When considering how to compare the Revenue chart with the App Store's financial reports, you should focus on Proceeds, since that measure represents the closest proxy we have to how you will be paid by Apple for a given transaction.

How the App Store's financial reports work

Apple’s monthly financial reports provide a list of transactions whose settlement date falls within the fiscal month that's being reported on. These are the transactions that you will receive a payout for on the scheduled payout date for that fiscal month. The report's primary purpose is to inform you of the transactions that will be included in your payout, and to (1) estimate your proceeds [before they're paid to you] or (2) describe your proceeds [after they're paid to you].

A transaction's settlement date is the date when the customer's payment is actually made to Apple. Often this will occur on the same day that a transaction is initiated by the customer; but may also occur on a later date, such as when Apple batches some payments together and charges them at once at a later time, or when a customer is due to renew their subscription on a given date but the attempted payment fails until some later date in their grace period.

The result is that the day a transaction is initiated and the day it settles is not always the same, and therefore a transaction may be paid out in a later fiscal month than the one it was initiated in.

Price fields

There are a few different fields in the App Store's financial reports that refer to the price paid by customers and the proceeds you'll generate as a result, and its important to understand the differences between them:

- Partner Share: "Proceeds you receive per unit. This is the Customer Price minus applicable taxes and Apple’s commission, per Schedule 2 of the Paid Apps Agreement."

- Extended Partner Share: "Quantity multiplied by Partner Share."

- Customer Price: "Price per unit billed to the customer, which you set for your app or in-app purchase in App Store Connect. This includes any applicable taxes we collect and remit per Schedule 2 of the Paid Apps Agreement."

(Source)

Customer Price is comparable to Revenue in RevenueCat, while Partner Share is comparable to Proceeds.

The Quantity field will inform you how many transactions of a given type there were in the fiscal month being reported on. When analyzing your proceeds, you must always take this field into account to get the correct figure, either by multiplying Customer Price or Partner Share by Quantity yourself, or by using the Extended Partner Share field.

Key Differences

Beyond the differences in what these data sources are intended for, there are also key differences in available data and definitions that can cause discrepancies between them, and its important to understand those differences so that you know exactly what's being measured and can make the most informed decisions.

Settlement date vs. transaction date

One of the primary distinctions is how transactions are grouped and reported. Apple’s financial reports include transactions based on their settlement dates, while RevenueCat groups them by transaction dates. For instance, a subscription renewal that was due on November 29, but fails to renew, and then later succeeds on December 4 during its grace period will appear in Apple’s financial reports based on the settlement date of December 4, while RevenueCat will report it on November 29, when the payment was due.

The primary reason for this is that Apple does not provide information to developers about transaction settlement dates, so the best data we have is the date when the transaction was initiated. Though this is a better source for understanding customer behavior, it does cause differences in the number of transactions being reported on in a given period.

Monthly calendar vs. fiscal calendar

Apple’s payout schedule adheres to their fiscal calendar, which almost never identically matches a calendar month. For example, their January 2025 fiscal month runs from December 29, 2024, to February 1, 2025.

Therefore, in order to compare identical periods between the Revenue chart and your App Store financial report, you need to set the Revenue chart to match the custom date range that represents that fiscal month you're analyzing.

(For more details, see Apple’s Fiscal Calendar.)

Estimated exchange rates, taxes, and commissions

While Apple’s reports do provide currency conversion rates, taxes, and commissions, their reports are intentionally anonymized. Without a way to connect data from Apple’s financial reports to individual transactions in RevenueCat, we can only know that some purchase had certain rates and deductions — but not which customer or transaction they applied to. This is why estimation is needed.

In the case of taxes and commissions, we use our system to estimate the amount deducted from the gross revenue of the transaction to yield proceeds based on Apple's pricing schedule which quotes the proceeds you can expect for each price in each currency. Learn more about how we estimate taxes and commissions.

In the case of exchange rates, Apple describes their process here:

Our bank converts payment amounts into the currency of your bank account. The exchange rate is established by our bank and, due to Apple's volume, is generally a more favorable rate than used by your local bank. The rates are typically the spot rate on the date of payment and no more than three business days prior to the date the proceeds are received into your account.

Ultimately, that means the exchange rate that's used will not be set in stone until close to the payout date for that fiscal month, which is ~33 days after the end of the period, and therefore could be up to 68 days after the transaction occurred. And beyond that, the exact exchange rate that's used is likely better than what's publicly quoted on that day.

To bridge this gap, RevenueCat converts transactions from their purchase currency to USD based on values from Open Exchange Rates as of the purchase date of the transaction (or to any other display currency you have set in the Dashboard). However, that means there may be differences in the exact revenue being attributed for each transaction, especially during periods of meaningful exchange rate volatility.

Refund Attribution

Apple’s financial reports attribute refunds to the date when they occur, deducting refunded revenue from the overall payout for that fiscal month. RevenueCat, on the other hand, deducts refunds from the date of the original transaction that was refunded.

Implications for Developers

The differences between RevenueCat’s and Apple’s methodologies and available data mean that discrepancies are inevitable. RevenueCat’s data might slightly over-report or under-report proceeds for a specific period compared to Apple due to transactions settling in different months, or might have slight variations due to exchange rate differences or an imprecise tax estimation. However, over time, these discrepancies should balance out across multiple reporting periods.

When using these data sources to operate your business, we recommend that you:

- Use RevenueCat for trend analysis, real-time insights, and estimating future earnings.

- Rely on Apple’s financial reports for accurate payout data, financial reporting, and all accounting use cases.

- And always keep in mind these nuances of settlement dates, Apple's fiscal calendar, exchange rates, tax & commission estimations, and refund attribution when attempting to reconcile the two data sources.

By understanding the methodologies behind these tools, you can better utilize their strengths and make informed decisions when operating your business.